Time Series

Unit... 1.1

Time series

There is nothing constant in the universe

All ebb and flow, and every shape that’s born

Bears in its womb the seeds of change.

-Ovid

The world is dynamic. There is nothing stable or constant in world. Changes are taking place at every moment of time. It is rightly said that the importance of time is great. Changes are taken place continuously in statistical time series also. It is necessary to study the changes and to classify these changes and to compare with similar changes in the other series. If we are able to identify the reasons behind these changes, we may predict the future changes by knowing the direction of past changes. Really, is it not the significant advantage? So, in modern world especially in economic and business world the analysis of time series becomes important day by day.

1.1 Meaning of time series

Forecasting is often necessary in the

field of economics, commerce and management. We know that many variables vary

with time. For example if we look at the figures of population, agricultural

production, industrial production, exports, sales, employment, prices,

electricity consumption etc. we find that the figures change with time.

A set of figures relating to a variable arranged according

to time is called a time series.

Consider the following series of production (in thousands of

tones) of a company.

|

Year |

1964 |

1965 |

1966 |

1967 |

1968 |

1969 |

1970 |

1971 |

|

Production |

35 |

39 |

44 |

33 |

45 |

54 |

57 |

56 |

This is a time series. It is used for forecasting. It is

also called as historical series since it describes the history of the

variable. Some other definitions of time series are:

According to Morris Hamburg, Time series is a series of statistical observations arranged in a

chronological order. The observations in the chronological order indicate the

order of occurrence, taken at regular successive intervals of time. The time

intervals may be years, months, days, minutes and in some cases seconds also.

Mathematically time series is defined by the values Y1, Y2

, ----- , Yn, ----of the variable

Y at times t1, t2 , ----- , tn,

----. The time points t1,

t2 , ----- ,

tn, --- are equidistant. This definition is due to Spigel.

Here time series is a function of time i.e. Y = F(t). Thus, in time series time

is an independent variable and Y(t) is dependent variable. We denote time

series by Y(t) or Yt. In the form of function the time series is

represented as follows:

|

t |

t1 |

t2 |

t3 |

---- |

tn |

|

Yt |

Y1 |

Y2 |

Y3 |

---- |

Yn |

The examples of time series are:

1. Daily price of

gold

2. Weekly sales of

departmental store

3. Monthly deposits

in a certain bank

4. Yearly production

of food grains of a country

5. Daily record of maximum or minimum temperature of a city

6. Population of a country at census years.

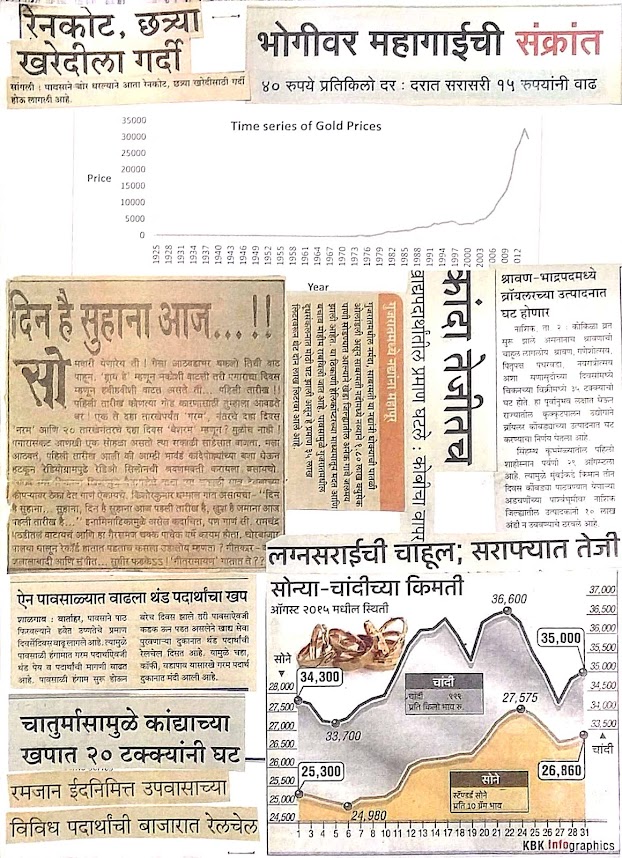

If we carefully observe the figures in the above given

example of time series of production, we see that the production is increasing,

although for some years it has decreased. The graph of this time series

is:

Figure 1.1

The graph of

time series is called as Historigram and its nature is usually zig-zag or

haphazard. It is obtained by plotting the data on a graph paper taking the independent

variable time (t) along X - axis and dependent variable y along Y -axis.

1.2 Components of time series

The factors responsible for the changes

in the time series are called as components of time series. There are four

components of time series.

1. The secular trend or trend: An overall tendency of the series to rise or

to fall.

2. Seasonal variations: A regular up and

down due to seasons.

3. Cyclical variations: Changes due to

booms and depressions.

4. Irregular variations: Changes due to

unpredictable causes.

1.3 Utility (Importance) of analysis of time series:

The analysis of time series is of great

importance to economists and businessmen, because it helps them to understand

past, to control the present (comparison) and to plan for the future

(forecasting).

1. It helps to

understand past

By analysis of time series, we can understand the past

behavior of the variable. It is assumed that it will behave in future in the

same manner as it did in the past.

2. It helps to

plan for the future

By analysis of time series, we are able to predict the

future requirements and to plan our activities accordingly.

3. It helps to control present performance

By analysis of time series, we compare the actual performance with estimated performance and take the necessary steps. We also compare the two related time series by analysis of time series. For example; prices of gold and prices of shares.

1.4 Trend or Secular trend

The term secular trend or simply trend refers to the general tendency of

the variable to increase or decrease. For ex; the population, agricultural

production, prices, literacy etc. are increasing while death rate, illiteracy,

travel by bullock cart, yearly birth rates, cost of electronic goods

decreasing. The rise or fall may be steep or gradual. When we say that there is

an increasing trend, it does not mean that the variable is always increasing.

There may be some places where the variable decreases.

There are many factors which cause secular trend, the most

important of which is the rise in population. The rise in prices, in

population, in sales, in travel etc. is primarily due to the rise in

population. Besides these there are other factors which cause secular trend.

They are progress in science, improvements in technology, changes in culture,

habits and tastes of people.

Remarks:

1. The word secular is defined from Latin word saeculum which

means generation or age.

2. Trend is a long period movement. Period can not be

precisely defined ex. gold prices.

3. Trend is mostly monotonic, although original series is not.

4. Apart from the long term growth component, there are some

short term periodic rhythmic

variations. These variations disturb the smoothness and monotony.

5. Trend is useful for two reasons: i) For comparison of two

series

ii)

It helps to extrapolate.

1.5 Seasonal variations

This

kind of variation is basically due to the seasons of the year. But it also

includes the variations of any kind which are periodic in nature and whose

period is less than a year. The ups and downs due to bazaar days or on weeks of

month or on months of a year are seasonal variations. The factors causing seasonal

variations are:

1. Seasons of a year

The most important factor

which causes seasonal variations is

the seasons of a year. There will be

an increased demand for umbrellas, raincoats etc. in rainy season; for hats, sunglasses,

cold drinks etc. in summer and for warm clothing in winter.

2. Festivals and Customs

The factors such as

festivals, customs or traditions cause seasonal variations. For ex the demand

for clothe, sweet, crackers etc. increases during festivals like Diwali, Id,

Christmas. Also there is greater demand for gold, costly cloth, presentation

articles etc. during marriage seasons.

3. Practical needs

There are certain

practical needs which cause variation in the time series. There are large

withdrawals on the 1st of every month for payment of salaries. The

demand of electricity is very high during certain hours of the day. There is

heavy rush for local transport during certain hours of the day.

The third

component in time series is the cycle which is different from trend or seasonal

variations. Cyclic variations are very common in economic and business

activities. They show oscillating movements upward and downward forming a wave

i.e. a cycle. There are four phases of a business cycle

i)

Prosperity ii) Decline ( Recession) ii) Depression iv) Improvement ( Recovery)

The

interval of time from one prosperity to next is called the period of cycle and

it is anywhere between 3 to 10 years. Business cycle is the main cause behind

the cyclic variations. Imbalances in economy, import and export facilities

& policies, availability of loans, inflation, over development, decreasing

efficiency of personnel (automation) and business competitions are some reasons

for the business cycle.

Difference between seasonal variations and cyclic variations:

i) Reason: Seasonal variations are due to seasons,

festivals, customs and needs of people while cyclic variations are due to business

cycle.

ii) Period: Seasonal variations are up and down

swings of period less than a year. Cyclic variations are of period 3 to 10

years (or higher).

iii) Intensity: The intensity of seasonal variations is

less than the cyclic variations.

1.7 Irregular variations

These variations are also

called as random variations. They include all those variations which are not

covered by the above three components and which are caused by factors other

than those discussed earlier.

The causes of irregular variations

are accidental like wars, earthquakes, floods, famines, fires, strikes etc.

These factors are unpredictable, irregular variations are uncontrollable.

1.8 Analysis of time series

The study of

time series i.e. the study of change in the figures of time series is called as

analysis of time series. It’s purpose is two fold.

i) Identifying

the four components which cause variations

ii) Isolating,

studying and measuring each of them independently.

1.9

Mathematical Models of Time Series:

In analysis, it

is required to know how the components interact and give the joint effect. This can be done with the help of models. There

are two models commonly used for the decomposition of time series in to its

components.

i) Additive

Model

Under additive model, the time series

can be expressed as,

Yt

= Tt + St + Ct + It

where Yt is the time series value

at time t and Tt, St, Ct and It represents the

trend, seasonal, cyclical and random variations at time t. In this model St, Ct

and It are absolute values and can have positive and negative. The model

assumes that all the four components of time series are independent of each other.

In this model, the decomposition of time series is done on the assumption that

the effect of various components are additive in nature.

ii)

Multiplicative Model

Under

multiplicative model, the time series can be expressed as

Yt

= Tt × St × Ct × It

According to

this model the decomposition of time series is done on the assumption that the

effects of the four components are not necessarily independent. In this model

S, C, and I are not absolute amounts as in case of additive model. They are

relative variation and are expressed as rate or indices below or above unity.

This model assumes that these four components are mutually independent.

1.10

Measurement of Trend

The following

are the four methods which are generally used for the measurement of the trend

in a time series.

i) Inspection

(or Free hand curve fitting) method

ii) Moving

averages method

iii)

Progressive averages method

iv)Principle of

least squares method.

1.11

Moving average method

This method

consists of determining the arithmetic means for given number of years, months

or days etc. This average value is supposed to be the proper or trend value for

the middle period. By taking such averages the effects of the other variations

is reduced. The period of moving averages is taken between 3 years and 10

years. Period depends upon the cycle of data.

If

the period of moving averages is an odd number i.e. 3,5,7, -- years, the average calculated is written at

the middle year. If it is an even number ( 2,4,6,8,--years ), after calculating

the averages for that period, again the averages of each pair of adjacent

moving averages are calculated. They are called the centered moving averages.

Merits:

1. It is simple than method of least squares

2. If period of cycle is equal to period of moving averages, cyclic variations are removed.

Demerits:

1. Irregular variations are not removed. So can’t used for prediction only

for estimation.

2. Trend values can not be calculated for all the years.

1.12 Progressive average method

In the early years

of a firm, data over a long period are not available. So the method of moving

average is not used. Progressive average method is used. Progressive averages are the cumulative

averages. To calculate the progressive averages, we calculate the cumulative

sums and divide the sums by 1, 2, 3, ---- and so on. A column is also prepared

for the difference between the actual values and the corresponding progressive

averages. Thus, if

the time series values are y1, y2, y3, ------

the progressive averages are

Merit:

It is highly useful to study the trend during the

childhood of a concern.

Demerits:

Progressive averages are not useful as

the industry is grown up.

1.13

Least square method

Fitting of Linear Trend:

The idea of least

squares was developed by Gauss in 1975 and is most widely used method of

fitting a mathematical function to a given set of data.

Σ y = n a + b Σ t .... (4)

Σ t y = a Σ t + b Σ t2 .... (5), where n is the number of time series

pairs (t, y).

It is seen that equation

(4) is obtained by taking sum of both sides in equation (1) and equation (5) is

obtained on multiplying equation(1) by t and then summing both sides over the

given values of the series. Solving (4) and (5) for a and b and substituting

these values in(1), we finally get the equation of the straight line trend.

Merits:

1. It is more accurate than method of moving averages and progressive

averages least squares

2. Trend line can be used for prediction as well as estimation.

3. It is objective method free from personal bias.

Demerits:

1. It is quite tedious and time consuming , so difficult to nonmathematical person.

2. Addition of one value would require making calculations freshly, which is not so in other methods.

Multiple Choice Questions

1. The long term regular movement in a time series is called

as ………

a) seasonal variation b) cyclical variations c) secular

trend d) irregular variations

2. Time series analysis helps to ………

a) make predictions b) compare two or more series c) know

behavior of business d) all of these

3. Given that;

Statement I: Seasonal variation has period of less than one

year.

Statement II: Cyclical variation has period of more than one

year.

a) Statement I is false b) Statement II is false c) Both are

false d) Both are true

4. Periodic change in values of time series is ………

a) seasonal variation b) cyclical variations c) both a and b

d) irregular variations

5. If all four components of time series operate

independently then we use………

a) additive model b) multiplicative model c) exponential

model d) none of these

6. A time series is a set of data recorded ………

a) periodically b) at time or space interval c) both a and b

d) neither a nor b

7. Trend in a time series means ………

a) long-term regular movement b) short-term regular movement

c) at successive points of time d) all of these

8. Moving average method suffer from ………

a) the loss of information b) the element of subjectivity

c) the decision about the number of years in group d) all of

these

9. Which of the following is not a method of measuring

trend?...………

a) Moving averages b) Simple averages c) Least squares d) Progressive averages

10. The variation in the production due to strike in a

company is ....…

a) seasonal variation b) cyclical variations c) secular

trend d) irregular variations

11.

|

Year |

2005 |

2006 |

2007 |

2008 |

2009 |

|

Sale in lakhs |

4 |

7 |

10 |

13 |

16 |

|

X |

|

|

|

|

|

From the above information of the time series, X is ………

a) 4 yearly moving averages b) 2 yearly moving averages

c) 3 yearly moving averages d) none of these

12. Time series analysis helps to ………

a) understand the behavior of a variable in the past b) plan

future observation

c) predict the future behavior of a variable d) all the

above

13. To which component of time series the term recession is

attached?…

a) trend b) seasonal c) cyclical d) random variation

14. Moving average method of fitting trend in a time series

data removes the effect of …

a) long term effect b) cyclical variation c) short term

movements d) none of these

15. An additive model of time series with components T, S, C

and I is…

a) Y = T + S + C × I b) Y = T + S × C × I c) Y = T + S + C +

I d) Y = T + S × C + I

Short

answer questions

1. What is time series? State four components of time

series.

2. Describe moving average method for determining trend.

3. State different components of time series and explain any

one of them.

4. What is secular trend? Describe the method of least

squares to determine secular trend.

5. State utility of time series.

Big

answer questions

1. Explain the following terms with suitable illustration;

i) secular trend and ii) seasonal variation

2. What is secular trend? What are the methods for measuring

trend? Describe any one of them.

3. What is time series? State four components of time

series. Describe any one of them

4. What are the different models for time series? Describe them.

5. Discuss the simple average method for measuring seasonal variation.

Comments

Post a Comment